PE/VC funds basically invest in the potential high growth of their portfolio companies. Therefore, it is critical that they assess and

ensure that the growth drivers of the business is in place, before they invest. Further, they need to ensure that these growth drivers are

nurtured by the management team during the life of the investment in order for the fund to realize a profitable exit.

Wouldn't it be great if you had a single instrument that could help the fund manager during the entire investment lifecycle -

from idea scrutiny through deal monitoring and finally exit?

An Intellectual Capital

Report is just such an instrument. It is effectively a performance scoreboard that will enable the fund manager to quickly understand the value proposition of the prospect

in terms of its core competencies. You will see how these core competencies are managed

by the prospect for sustained value creation. What's more, you will also receive an unbiased independent valuation of these core competencies,

that can be used to up-sell the investment at exit.

Discover your Prospect's Intellectual Capital using ICValue™

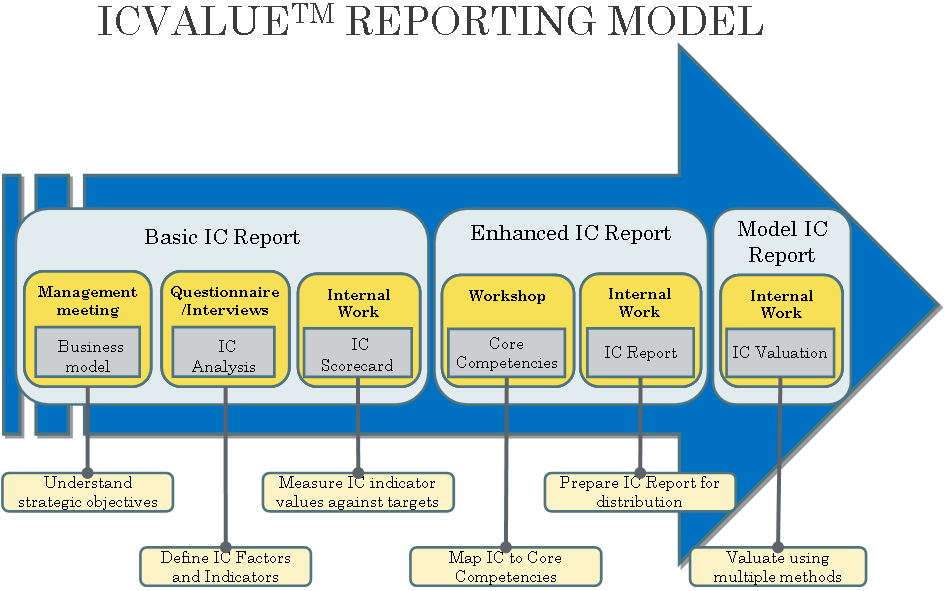

ICValue™ is a comprehensive framework developed by Attainix Consulting for defining the Intellectual Capital of any

business in a three phased manner, as follows.

At Attainix Consulting, we help you with the fund rasing process for your early growth

and expansion capital requirements as depicted in the picture alongside.

We have developed the ICQuickValueTM methodology to especially

address all the fund raising challenges listed above. We will create a business

plan and projected financials, of course. But that is not enough! Investors want

to understand your value proposition, quickly. They also want to understand

your plan for nurturing and nourishing your value proposition.